Even by the standards of startups in the technology obsessed Middle East, the growth of Buy Now Pay Later (BNPL) provider Tamara has exceeded all expectations.

Launched in September 2020 in Riyadh, Saudi Arabia, by serial entrepreneur Abdulmajeed Alsukhan and partners Turki Bin Zarah and Abdulmohsen Albabtain, after just four months Tamara closed $6 million of funding in the largest seed round in the country’s history. In April the startup topped that in style by raising no less than $110 million in a record-breaking Series A round led by global payments provider Checkout.com.

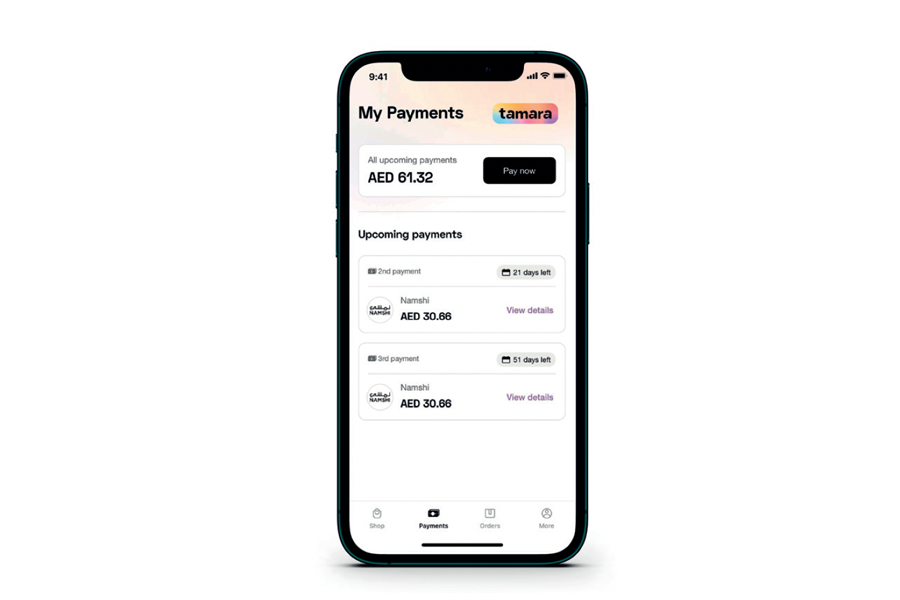

Like many ecommerce companies around the world, Tamara is benefitting from the massive rise in online consumer spending that has taken place during the pandemic. Its BNPL solution allows consumers to pay for products in installments, without incurring any interest charges. The company’s revenues come from fees paid by merchants, who have fallen over themselves to partner with Tamara and offer their customers an innovative and intuitive way to buy big-ticket items, both online and in-store.

Co-founder Abdulmajeed says that the pandemic is not the only reason for Tamara’s rapid growth rate or its appeal to global investors. Authorities are also giving local startups all the support they need to roll out innovative services to Saudi Arabia’s young, aspirational and tech-savvy population.

In Tamara’s case, the company was the first BNPL firm to be enrolled in the Saudi Central Bank’s sandbox program, where fintechs are given free rein to turn bright ideas into licensed businesses. “The government knows that you can’t expect major innovations from incumbent companies, so it is empowering tech startups like Tamara,” Abdulmajeed says.

Flush with cash and buoyed by supportive regulations, Tamara is expanding rapidly across the entire Gulf region and beyond. “The market is incredibly receptive, but BNPL is still a nascent phenomenon,” Abdulmajeed says. “There is huge room for growth.”

“For me as an entrepreneur and for Tamara as a company, raising money is not the objective. Our objective is to deliver the best products, delight our customers, and change the world.”

Abdulmajeed Alsukhan, CEO and co-founder of Tamara

What is the secret to Tamara’s success?

We help people budget for their purchases. Sometimes people have events coming up or products they want to buy that require a higher budget. They can use Tamara to split that cost into smaller payments. We are a trustworthy financial partner for our customers.

We are not a credit card company. We don’t make money if customers are late – in fact, we lose money. The way we make money is to integrate with merchants so that we are one of the options at checkout. When you buy an item from one of our merchant partners, you see Tamara alongside the global payment brands.

Why do you think Saudis have adopted BNPL so enthusiastically?

Banks and other service providers used to take their customers for granted. Service quality was low, without innovation or new products that matched daily needs.

Now the country is at an inflection point. Saudi Arabia and the Gulf region in general has one of the highest rates of penetration and growth in BNPL. Traditional financial service providers like banks are not loved by their customers. But new fintech brands are building a people-first culture from the beginning. Tamara is at the forefront of this trend. We are determined to make that change in the financial industry.

How does BNPL empower merchants?

Tamara enables consumers to purchase a higher ticket value. The ticket size of an item bought using Tamara is 80% higher than any other payment method. We also allow people to buy more of their favorite brands. Our merchants are seeing an increase in completed online sales and a huge increase in their top lines.

How is the startup culture in Saudi Arabia developing?

Five years ago, no-one in Saudi Arabia really knew what a startup was. Now we are seeing multiple venture capital funds across the region. The change that has happened here has been tremendous. There is a new wave of startups in the country. There is no better time than now to start something.

This is one of the missions of Tamara. We want to show people in the region that they too can develop successful, innovative businesses. Stories like ours will inspire them![]()

Published as branded content in WIRED